Low inventory has been the story on the national housing market, and the Lewis Center OH real estate market is no exception. The low housing inventory and increased buyer demand has brought home prices up nationwide.

In the current Lewis Center Seller's Market, home buyers may be struggling to find their dream home. While high demand and low inventory may be great for sellers, for buyers this potentially means difficulty finding a home, multiple offers when they do find a home, and offers that are above asking price.

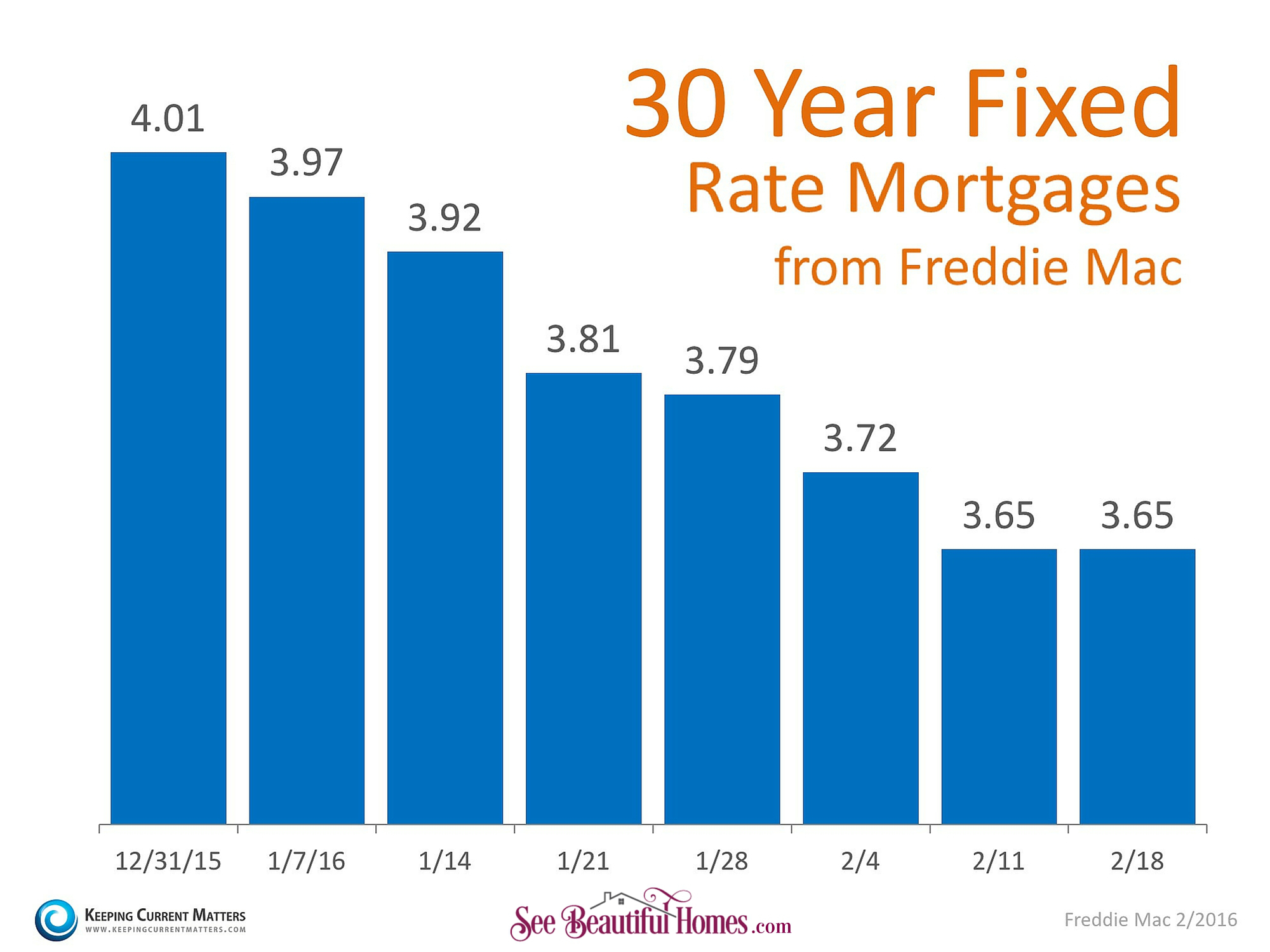

But buyers, don't throw in the towel! Because with both interest rates and prices in Lewis Center predicted to rise, it is still an ideal time to lock in a fantastic rate and get a good value long term on Lewis Center OH real estate.

Let's Look At The Lewis Center OH Real Estate Numbers

With the first quarter in our rear view mirror and the spring housing frenzy upon us, let's take a minute to look into Lewis Center, OH real estate market statistics from the major housing websites. If you're a Lewis Center home owner and it's been some time since you checked out the local real estate market, you may be pleasantly surprised to learn that the Columbus market is now considered a Seller's Market on Zillow.

1st Quarter Real Estate Market Data For Lewis Center, OH

Days On Market Edging Down In Lewis Center

According to Realtor.com, homes for sale are selling quickly on the Lewis Center OH real estate market, with only 37 days on the market in March 2016. This is down from 41 days on market in March 2015 and 58 days on market in January 2013. For buyers, lower days on market means you need to see Lewis Center real estate listings the moment they hit the market. Then, when you see a home you like, call me to schedule a showing immediately. With such a low average days on market, this means that the best houses are going under contract in a matter of days.

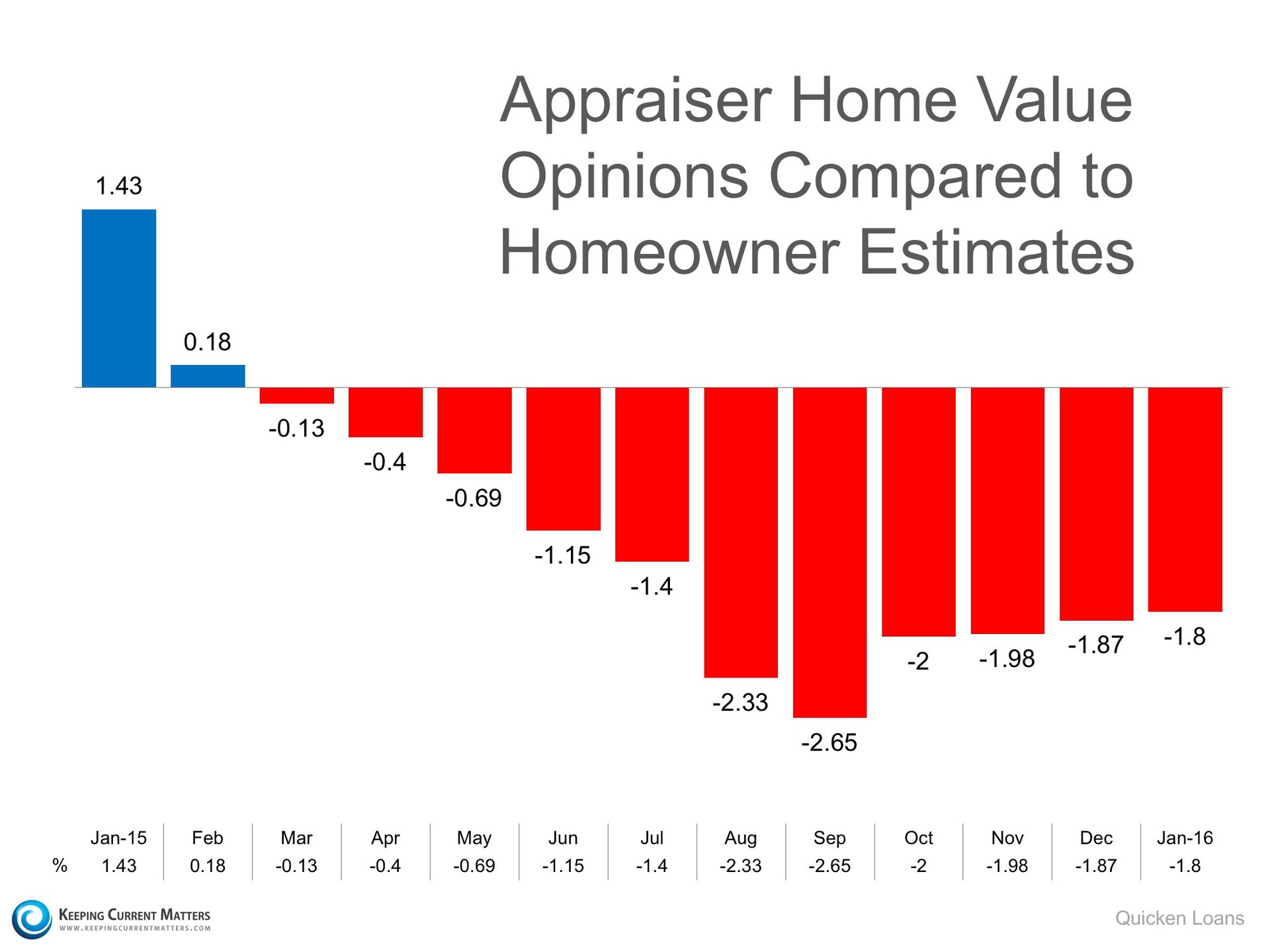

Lewis Center's Median Listing Price Creeping Up

The median listing price according to Realtor.com is $341,000, which is up from $250k three years ago. Median closing price for Lewis Center OH real estate is $267,000 on Realtor.com. The median Listing Price Per Square Foot is also on the rise in Lewis Center. The March 2016 median listing price per square foot according to Realtor.com was $120. This is up from $110 in March 2015, and up from $100 in March 2013.

Zillow is predicting Columbus area home values will rise 3.5% over the next year, so now is still a great time to start your home search in Lewis Center.

Finding Lewis Center OH Real Estate For Sale

If you're ready to buy a home, but you're having a hard time in a seller's market, let a Lewis Center OH real estate professional help you get the upper hand in your home search.

Get the latest Lewis Center real estate listings with our Hot Homes List. Our Lewis Center Hot Homes List gives you access to the newest listings in Lewis Center! You'll see homes for sale before other buyers, and you'll even see homes before they hit Zillow or Trulia!