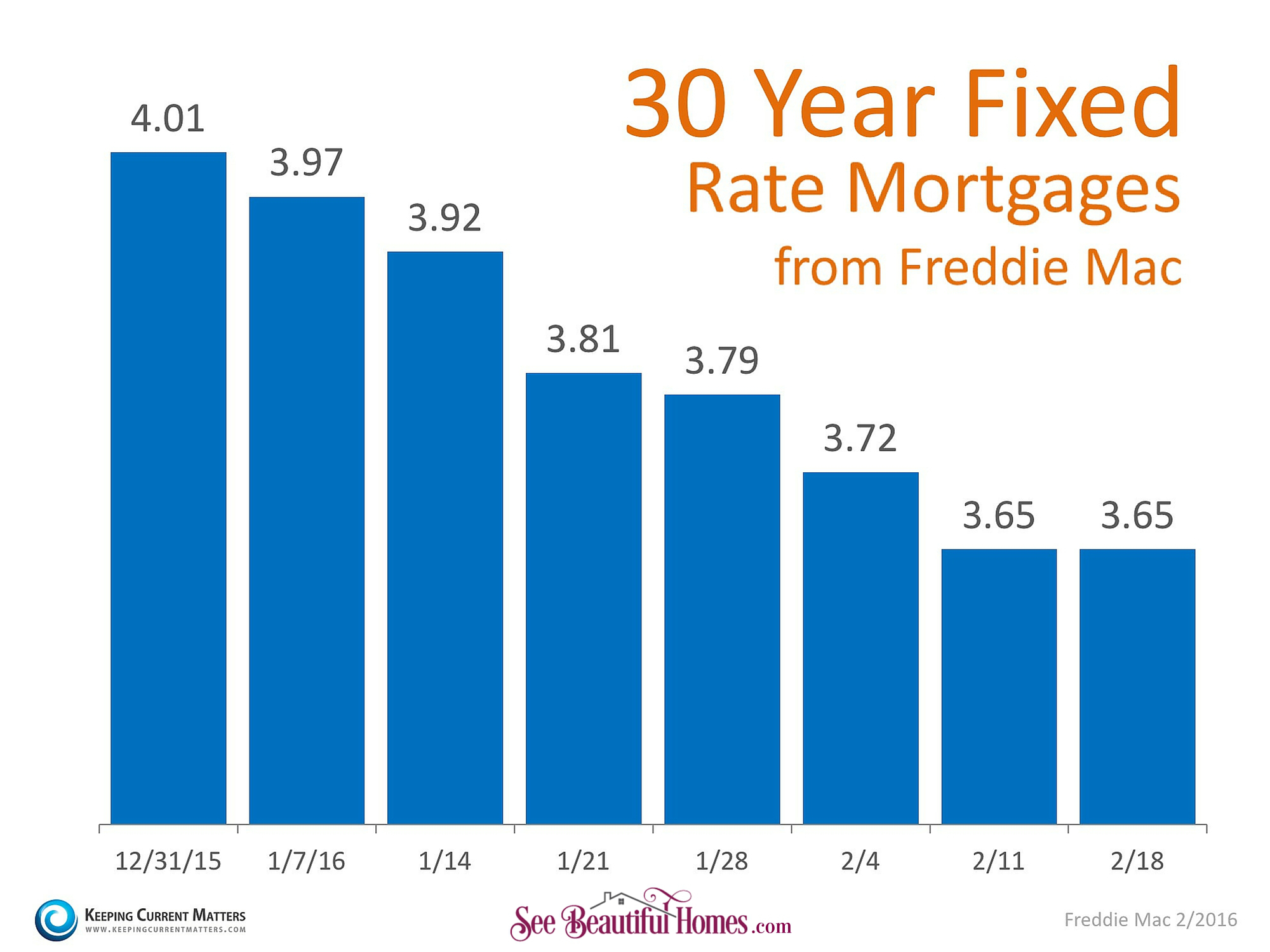

Just two weeks ago, we posted an article discussing where mortgage interest rates may be heading over the next twelve months. We quoted projections from Fannie Mae, Freddie Mac, the Mortgage Bankers’ Association and the National Association of Realtors. Each predicted that rates would begin to rise slowly and steadily throughout 2016.

However, shaky economic news and a volatile stock market have actually caused rates to drop six out of the last seven weeks, and have remained at 3.65% for the past two weeks.

Rates have again fallen to historic lows yet many experts still expect them to increase in 2016. The only thing we know for sure is that, according to Freddie Mac, current rates are the best they have been since last April.

Bottom Line

If you are thinking of buying your first home or moving up to your ultimate dream home, now is a great time to get a sensational rate on your mortgage.

Rita Boswell is who to notify when you are moving, a recognized leader in her field. Rita can be reached via email at rboswell@kw.com or by phone at 614-270-4499. Rita has helped people move in and out of many Central Ohio communities.

Search for Central Ohio homes at www.SeeBeautifulHomes.com

“Thinking of selling your home? I have a passion for Real Estate and love to share my marketing expertise!”

I service Real Estate sales in the following Central Ohio towns: Dublin, Powell, Delaware, Lewis Center, Galena, Sunbury, Westerville, Worthington, Columbus, Hilliard, New Albany, Blacklick, and Gahanna.

See all my Rave Reviews. People Say The Nicest Things!