The financial crisis affected so many who had no choice but to sell or relinquish their homes and take a credit hit. Those who did are starting to see their credit improve and are wondering if it’s time to re-visit the world of homeownership.

Many of you are understandably more cautious, yet homeownership is still the best way to wealth building. The key is using the lessons of the past to avoid another misfortune.

If your credit is in good shape, you are more ready to get back into homeownership. Homeowners have up to 45 times the wealth of renters. It really comes down to whose wealth do you want to build? Your landlord’s or your own?

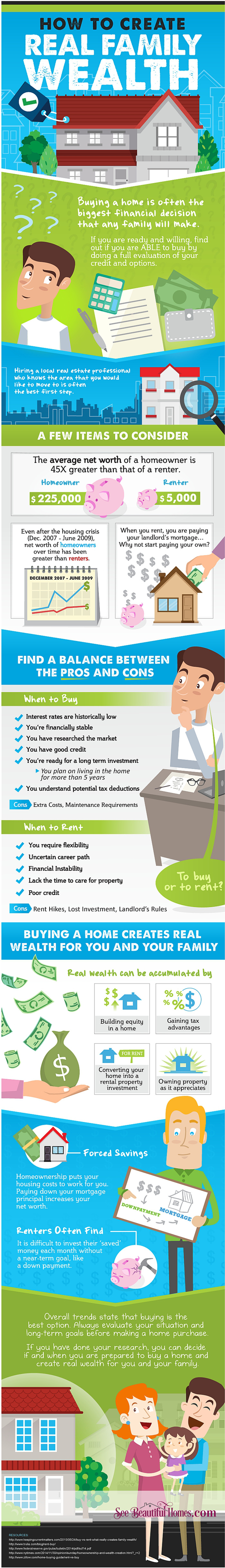

Some Highlights:

- Buying a home is often the biggest financial decision that any family will make.

- The average net worth of a homeowner is 45x greater than that of a renter.

- Homeownership puts your housing costs to work for you.

- Infographic was created in cooperation with Jensen & Co.

Rita Boswell is who to notify when you are moving, a recognized leader in her field. Rita can be reached via email at rboswell@kw.com or by phone at 614-270-4499. Rita has helped people move in and out of many Central Ohio communities.

Search for Central Ohio homes at www.SeeBeautifulHomes.com

“Thinking of selling your home? I have a passion for Real Estate and love to share my marketing expertise!”

I service Real Estate sales in the following Central Ohio towns: Dublin, Powell, Delaware, Lewis Center, Galena, Sunbury, Westerville, Worthington, Columbus, Hilliard, New Albany, Blacklick, and Gahanna.

See all my Rave Reviews. People Say The Nicest Things!